Trump Recruiting Goldman Sachs x7 to help MAGA

1

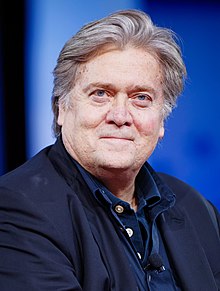

White House Chief Strategist and Senior Counselor to the President

master's degree in national security studies in 1983 from Georgetown University School of Foreign Service.[52]

Bannon graduated from Benedictine College Preparatory, a private, Catholic, military high school in Richmond, Virginia, in 1971,[49

worked at Goldman Sachs as an investment banker in the Mergers and Acquisitions Department.[64]

In 1987, he relocated from New York to Los Angeles, to assist Goldman

in expanding their presence in the entertainment industry.[49] He stayed at this position with Goldman in Los Angeles for two years, and left with the title of vice president.[65][b]

In 1990, Bannon and several colleagues from Goldman Sachs launched their own company Bannon & Co., a boutique investment bank specializing in media.

- On August 20, 2020, a federal grand jury indictment was unsealed against Bannon and three others, charging them with conspiracy to commit wire fraud and money laundering. Each charge has a maximum penalty of 20 years in prison upon conviction.[248][249][250]......On November 15, 2021, Bannon surrendered to FBI authorities.[279] He was released without bail, but he must keep authorities informed of his whereabouts, and he cannot leave the country.[280] He pleaded not guilty, and his trial is scheduled for July 18, 2022.[281]

- In Afghanistan, he supported a proposal by Erik Prince for the deployment of private military contractors instead of the U.S. military.[299]

- German film director Leni Riefenstahl, who produced propaganda films for the regime in Nazi Germany, is said to have influenced Bannon's film-making techniques, with Bannon once describing himself to writing colleague Julia Jones as the "Riefenstahl of George Bush", modifying the ending as "the GOP" when Jones was horrified.[363] The opening of Bannon's documentary film The Hope & The Change (2012) consciously imitated Riefenstahl's film The Triumph of the Will (1935), which depicted the Nuremberg Rally held in 1934.[364]

- Bannon was charged with misdemeanor domestic violence, battery, and dissuading a witness in early January 1996 after Piccard accused Bannon of domestic abuse. The Santa Monica Police Department crime report states that after Piccard called 911, an officer arrived at their home and observed red marks on Piccard's wrist and neck.[370][371] The charges were later dropped when Piccard did not appear in court.[372] In an article in The New York Times, Piccard stated her absence was due to threats made to her by Bannon and his lawyer:

2

77th United States Secretary of the Treasury

1985, Mnuchin joined the investment bank Goldman Sachs where his father, Robert Mnuchin, was a general partner. Mnuchin worked at Goldman Sachs for 17 years, eventually becoming its chief information officer. After he left Goldman Sachs in 2002, he worked for and founded several hedge funds and launched Dune Entertainment, a motion picture production company that financed several films for 20th Century Fox.

initiated into Skull and Bones in 1985.[21]

Until he left the company in 2002, Mnuchin held the following positions as a partner:[26][27]

- November 1994 – December 1998: Head of the Mortgage Securities Department

- December 1998 – November 1999: Overseeing mortgages, U.S. governments, money markets, and municipals at Fixed Income, Currency and Commodities Division

- December 1999 – February 2001: Member of the Executive Committee and co-head of the Technology Operating Committee

- February 2001 – December 2001: Executive Vice President and co-chief information officer

- December 2001 – 2002: Executive vice president, member of the Management Committee, and chief information officer[28]

- After he left Goldman Sachs in 2002, Mnuchin briefly worked as vice-chairman of hedge fund ESL Investments, which is owned by his Yale roommate Edward Lampert.[29] From 2003 to 2004 he worked as Chief Executive Officer at SFM Capital Management, a fund backed by George Soros.[30][31]

- In 2009, a group led by Mnuchin bought California-based residential lender IndyMac, which had been in receivership by the FDIC and owned $23.5 billion in commercial loans, mortgages, and mortgage-backed securities. The purchase price was a $4.7 billion discount to its book value.[36][9] Mnuchin's investment group included George Soros, hedge-fund manager John Paulson, former Goldman Sachs executive J. Christopher Flowers, and Dell Computer founder Michael Dell.[9][37]

- The campaigns of Al Gore, Hillary Clinton, John Kerry, Barack Obama, and Mitt Romney were among those to which he donated money.[56] Mnuchin said most of those donations were favors for friends.[33]

- Between June and September 2016, Mnuchin donated over $400,000 to the Republican Party, including donations to Paul Ryan and Donald Trump. Earlier in 2016, Mnuchin had donated $4,000 to Democrats Kamala Harris and Michael Wildes.[56]

3

11th Director of the National Economic Council

Cohn was hired by Goldman Sachs in 1990 and became a partner at the firm in 1994.[18] In 1996, he was named head of the commodities department, and in 2002, he was named the head of the Fixed Income, Currency and Commodities (FICC) division. In 2003, he was named co-head of Equities, and in January 2004, Cohn was named the co-head of global securities businesses.[19] He became president and Co-Chief Operating Officer, and director in June 2006.[20] While at Goldman Sachs, Cohn was also a member of the firm's board of directors and Chairman of the Firmwide Client and Business Standards Committee.[4]

In 2010, Cohn testified to Congress on the role of Goldman Sachs in the financial crisis of 2007–2008.[21] Cohn testified: "During the two years of the financial crisis, Goldman Sachs lost $1.2 billion in its residential mortgage-related business. We did not 'bet against our clients', and the numbers underscore this fact."[22]

4

1st United States Deputy National Security Advisor for Strategy

5

White House Communications Director

Scaramucci worked at Goldman Sachs's investment banking, equities, and private wealth management divisions between 1989 and 1996

Scaramucci began his career at Goldman Sachs

in 1989, in the Investment Banking division. A year later he was fired,

then rehired two months later in the Equities division. In 1993, he

became vice president in the bank's Private Wealth Management division.[14][15][16]

6

James H. Donovan is Vice Chairman of global client coverage at Goldman Sachs,[1]

On March 15, 2017 President Trump nominated Donovan to serve as Deputy Secretary of the Treasury.[3] He was nominated despite concerns within the administration that with the addition of Donovan there were "too many Goldman guys" in top posts.[4] Donovan withdrew from consideration on May 19, 2017.[5][6]

President Trump appointed Donovan to serve as a member of the President's Intelligence Advisory Board.[7]

7

32nd Chairman of the Securities and Exchange Commission

He specialized in mergers and acquisitions transactions and capital markets offerings[7] and represented prominent Wall Street firms, including Goldman Sachs.[9] He served as an adviser to numerous companies regarding issues related to the SEC, Federal Reserve, Department of Justice, and other agencies.[10]

During the financial crisis of 2007–2008, Clayton advised Bear Stearns in its fire sale to JPMorgan Chase in 2007, Barclays Capital in the purchase of Lehman Brothers' assets following their bankruptcy, and Goldman Sachs in connection with the investment by Berkshire Hathaway.[4]

Clayton disclosed to the U.S. Office of Government Ethics that his other corporate clients had included Deutsche Bank, The Weinstein Company

Clayton earned $7.6 million in 2016 from his firm and has a family wealth of at least $50 million. A substantial portion of his holdings were in mutual funds of the Vanguard Group. His investments also included private funds managed by Apollo Global Management, Bain Capital, J.C. Flowers & Co., and Richard C. Perry but he divested these investments upon confirmation.[13]

BONUS :

Hillary getting called out by Trump for Goldman Sachs connections

Hillary gets money from them easily :

THE GOLDMAN SACHS BOARD :

Pulled 10/14

-Jesuit Schools(2) = #7&8

-Fraternity(2) = #1&10

-Private Catholic (2) = #4&6

-Private (3) = 1,3&10

-Double Ivy & Top Comcast/NBC figure ( many IVY leagure grads on the board not included)

- A Clinton supporter

& A NAVY info warfare & cyber specialist

- (CEO) of Goldman Sachs, a position he has held since October 2018. He has also been chairman of the bank since January 2019.[3] Before assuming his role as CEO, Solomon was president and chief operating officer from January 2017 to September 2018, and was joint head of the investment banking division from July 2006 to December 2016

- graduated from Hamilton College in Clinton, New York, where he earned a Bachelor of Arts degree in political science and government.[15]

- Solomon founded Payback Records in December 2018 in partnership with Big Beat/Atlantic Records.

- In January 2018, Solomon "discovered" that " a personal assistant" had stolen around 500 bottles from his rare wine collection, among them, seven from the French estate Domaine de la Romanee-Conti.[66] The personal assistant, Nicolas DeMeyer, was arrested in late January and indicted for the theft of $1.2 million worth of wine.[66][67] On October 9, 2018 Nicolas DeMeyer committed suicide by leaping to his death from the 33rd floor window of the Carlyle Hotel, minutes after he was scheduled to appear before a Manhattan judge in relation to the alleged wine theft.[68]

- Solomon has served on Hamilton College's board of trustees since 2005. He was elected as chairman of the board starting July 1, 2021. [69] He is on the board of directors of the Robin Hood Foundation, a charitable organization which attempts to alleviate problems caused by poverty in New York City.[70]

- From 2006 to 2011, she served as Executive Vice President and Chief Financial Officer of Marsh & McLennan, and Chairman and CEO of Mercer.[1][3][4][5][6][7] She sits on the Boards of Directors of Cisco Systems.[1][2][4][5][7][8] Previously, she sat on the Boards of Wal-Mart, Goldman Sachs, Orbitz and Worldspan.[1]

- She supports the Democratic Party.[1] She has supported Al Gore and Hillary Clinton, and she has made donations to EMILY's List.[1] She sits on the Boards of Trustees of the Atlanta Symphony Orchestra and the Elton John AIDS Foundation, where she serves as Treasurer.[1][2][5][9] In 2010, she earned $4,648,029.00.[6]

- 28th President of Harvard University (July 1, 2007 – July 1, 2018)

- Double IVY Grad

- Has New England ancestry and is a descendant of Jonathan Edwards, the third president of Princeton.[7]

- In 2014, she was ranked by Forbes as the 33rd most powerful woman in the world.[5]

4) Mark Flaherty

https://www.wsj.com/market-data/quotes/GS/company-people/executive-profile/131637807

- Director-Global Equity Trading at BNY Mellon Investment Funds I- "one of the largest asset managers in the world[1] with $2.4 trillion in assets under management as of December 31, 2021"

- Graduated from Providence College ( private Catholic university )& now a member of the boards of trustees of Providence College and The Newman School.

- Retired from Director-Global Trading at Wellington Management Co. LLP., an investment management company, where he served as vice chairman from 2011 to 2012 which has assets under management totaling over US$1 trillion based in Boston, United States. The firm serves as an investment advisor to over 2,200 institutions[2] in over 60 countries, as of 30 June 2020.[3] , he also was the director of global investment services from 2002 to 2012 and partner and senior vice president from 2001 to 2012.

- Prior to joining Wellington, from 1991 to 1999, worked at Standish, Ayer and Wood, an investment management company, serving variously over the course of his tenure as a director of equity trading, a partner and an executive committee member, and from 1987 to 1991

- Director-Global Equity Trading at Aetna, Inc., company is based on Mount Etna, at the time the most active volcano in Europe.[7]The company's network includes 22.1 million medical members, 12.7 million dental members, 13.1 million pharmacy benefit management services members, 1.2 million health-care professionals, over 690,000 primary care doctors and specialists, and over 5,700 hospitals.[3]

5) Kimberley Harris

- the U.S. Department of Justice, the White House, and as Executive Vice President of Comcast Corporation (2019 – Present) and General Counsel at NBCUniversal, (2013 – Present) where she is responsible for providing legal advice to senior management and overseeing legal function across all NBCUniversal divisions

6) Ellen Kullman :

https://en.wikipedia.org/wiki/Ellen_J._Kullman

- Double Private Catholic - Kullman attended Tower Hill School in Wilmington and then studied mechanical engineering at Tufts University, where she received her bachelor's degree in 1978.[4] In 1983, she received a master's degree in management from Kellogg School of Management at Northwestern University.[4]

- formerly Chair and Chief Executive Officer of E. I. du Pont de Nemours and Company ("DuPont") in Wilmington and is a former director of General Motors. Forbes ranked her 31st of the 100 Most Powerful Women in 2014.[2] Kullman retired from DuPont on October 16, 2015.[3]

7) Lakshmi Mittal

https://en.wikipedia.org/wiki/Lakshmi_Mittal

- Executive Chairman of ArcelorMittal, the world's largest steelmaking company,[8] as well as Chairman of stainless steel manufacturer Aperam.[9] Mittal owns 38% of ArcelorMittal and holds a 20% stake in EFL Championship side Queens Park Rangers.[10]

- In 2005, Forbes ranked Mittal as the third-richest person in the world, making him the first Indian citizen to be ranked in the top ten in the publication's annual list of the world's richest people.[11][12] He was ranked the sixth-richest person in the world by Forbes in 2011, but dropped to 82nd place in March 2015.[13] He is also the "57th-most powerful person" of the 72 individuals named in Forbes' "Most Powerful People" list for 2015.[14] His daughter Vanisha Mittal's wedding was the second-most expensive in recorded history.[15]

- Mittal has been a member of the board of directors of Goldman Sachs since 2008.[16] He sits on the World Steel Association's executive committee,[17] and is a member of the Global CEO Council of the Chinese People's Association for Friendship with Foreign Countries,[17] the Foreign Investment Council in Kazakhstan,[17] the World Economic Forum's International Business Council,[17] and the European Round Table of Industrialists.[17] He is also a member of the board of trustees of the Cleveland Clinic.[17]

- He graduated from St. Xavier's College(jesuit), affiliated to the University of Calcutta, with a B.Com degree in the first class.

8)

Santa Clara Univeristy ( JESUIT ) :

https://www.linkedin.com/in/peter-oppenheimer-ab2317122

- Apple, Inc.

- Senior Vice President (retired September 2014)

- Senior Vice President and Chief Financial Officer (2004 – June 2014)

- Senior Vice President and Corporate Controller (2002 – 2004)

- Vice President and Corporate Controller (1998 – 2002)

- Vice President and Controller, Worldwide Sales (1997 – 1998)

- Senior Director, Finance and Controller, Americas (1996 – 1997)

- Divisional Chief Financial Officer, Finance, MIS, Administration and Equipment Leasing Portfolio at Automatic Data Processing, Inc., a leading provider of human capital management and integrated computing solutions (1992 – 1996)

- Consultant, Information Technology Practice at Coopers & Lybrand, LLP (1988 – 1992)

9) Jan Tighe

https://www.goldmansachs.com/about-us/people-and-leadership/leadership/board-of-directors/jan-e-tighe.html

- United States Navy, Vice Admiral and various positions of increasing authority and responsibility (1980 – 2018), including:

- Deputy Chief of Naval Operations for Information Warfare and Director, Naval Intelligence (2016 – 2018)

- Fleet Commander or Deputy Commander, U.S. Fleet Cyber Command/U.S. Tenth Fleet (2013 – 2016)

- University President, Naval Postgraduate School (2012 – 2013)

- Director, Decision Superiority Division, Chief of Naval Operations’ Staff (2011 – 2012)

- Deputy Director of Operations, U.S. Cyber Command (2010 – 2011)

- Trustee, The MITRE Corporation ( It manages federally funded research and development centers (FFRDCs) supporting various U.S. government agencies in the aviation, defense, healthcare, homeland security, and cybersecurity fields, among others.[3][4]Also known as the Jason Group.

)

- Member, Strategic Advisory Committee, Idaho National Labs – National and Homeland Security Directorate

- Board Member, United States Naval Academy Foundation

- Member and Global Security Expert, Strategic Advisory Group, Paladin Capital Group

- Directorship Certified and Governance Fellow, National Association of Corporate Directors

Seems like a strange back round( heavy military) to be in money business , someone who is trained in information warfare including digital ?

10) David Vinair

https://en.wikipedia.org/wiki/David_Viniar

- Union College, New York, in 1976, where he majored in economics.[4] He then attended Harvard Business School, earning an MBA in 1980.[1]

- Union College is a private liberal arts college in Schenectady, New York. Founded in 1795, it was the first institution of higher learning chartered by the New York State Board of Regents, and second in the state of New York, after Columbia College (formerly King's College).In the 19th century, it became known as the "Mother of Fraternities",[5] as three of the earliest Greek letter societies were established there. The school was once referred to as one of the "Big Four" alongside Harvard University, Yale University and Princeton University, before the Civil War and a financial scandal led to its fall from grace and the top national rankings.[6]

- Viniar testified in front of the Senate Permanent Subcommittee on Investigations on Tuesday, April 27, 2010 regarding the role of investment banks in the financial crisis that began in 2007 and, specifically, the role of Goldman Sachs in that crisis.[13]

- Viniar served on the board of trustees of Union College and is a member of the board of trustees of both Children's Aid and Family Services and the Financial Accounting Foundation.[14]

Comments

Post a Comment